Which Stocks and Sectors Benefit from Interest Rate Cuts?

When interest rates are cut, borrowing becomes cheaper, which can stimulate investment and consumer spending. However, the effects of interest rate cuts ripple through various sectors of the stock market differently. Understanding which stocks stand to benefit can help investors make informed decisions in a changing economic landscape. In this article, we'll explore the types of stocks that typically gain from interest rate reductions and why.

Please note that this is our opinion and not financial advice. This is not a recommendation to buy or sell any securities. Always conduct your own research or consult with a financial advisor before making any investment decisions.

Stocks and Sectors That Typically Benefit from Interest Rate Cuts

| Sector | Sector ETFs |

|---|---|

|

Real Estate Stocks |

XLRE - SPDR Real Estate Sector |

| Real Estate Investment Trusts (REITs) | RWR - SPDR Dow Jones REIT |

| Consumer Staples | XLP - SPDR Consumer Staples Sector |

| Industrials | XLI - SPDR Industrial Sector |

| Utilities | XLU - SPDR Utilities Sector |

| High Dividend Yield Stocks | SDY - SPDR Dividend ETF |

Not all companies within a benefiting sector will perform well. It's crucial to assess individual company fundamentals. Diversifying investments using index funds similar to the ones listed above can help navigate the complexities of the market influenced by interest rate fluctuations.

Finding this useful? Learn more here.

Understanding Interest Rate Cuts

Before delving into specific stocks, it's essential to grasp what an interest rate cut entails. Central banks, like the Federal Reserve in the United States, lower interest rates to make borrowing cheaper. This move is often aimed at stimulating economic growth during periods of sluggish activity or recession. Lower interest rates can lead to increased spending by consumers and businesses, potentially boosting corporate earnings and, consequently, stock prices.

Stocks and Sectors That Typically Benefit from Interest Rate Cuts

For each sector, we'll briefly discuss how they could benefit from the upcoming interest rate cuts. We'll also use SPDR Index Funds to identify stocks within each sector and conduct technical analysis to see determine if the sectors are in a long-term uptrend.

Real Estate Stocks - XLRE

The real estate sector as a whole benefits significantly from interest rate cuts. Lower interest rates make mortgages and other types of loans more affordable, which can stimulate demand for both residential and commercial properties. This increased demand can drive up property values, benefiting real estate companies. Additionally, lower financing costs enable real estate companies to expand their operations, develop new properties, and refinance existing debt at more favorable rates, boosting their profitability.

XLRE Top 10 Holdings

XLRE Technical Analysis

XLRE has broken out of its long-term downtrend line on Friday, August 23.

A new uptrend is also forming, as indicated with the arrows by price making higher highs and higher lows.

The 50-Day SMA (blue) has also crossed above the 150-Day SMA (green) with both sloping up, confirming a long-term uptrend forming.

This indicates that stocks in the real estate sector are entering a long-term uptrend due to the confirmation of the rate cut cycle beginning.

Technical Outlook: Bullish

2. Real Estate Investment Trusts (REITs) Stocks - RWR

REITs often rely on borrowing to finance property acquisitions and developments. Lower interest rates reduce their borrowing costs, potentially increasing profitability. Additionally, lower rates can make real estate investments more attractive compared to fixed-income securities, driving up demand for REIT shares.

RWR Top 10 Holdings

RWR Technical Analysis

RWR has broken out of its consolidation pattern (shown by the red dotted line) on August 14.

A new uptrend is also forming, as indicated with the arrows by price making higher highs and higher lows.

The 50-Day SMA (blue) has also crossed above the 150-Day SMA (green) with both sloping up, confirming a long-term uptrend forming.

This indicates that stocks in the REITs sector are entering a long-term uptrend due to the confirmation of the rate cut cycle beginning.

Technical Outlook: Bullish

3. Consumer Staples Stocks - XLP

Consumer staples companies produce essential goods that people buy regardless of economic conditions. Lower interest rates can reduce their borrowing costs, and the stability of their products can make them more attractive during uncertain times.

XLP Top 10 Holdings

XLP Technical Analysis

XLP has broken out to new all-time highs on August 21, 2024.

A clear uptrend has formed, as indicated with the arrows by price making higher highs and higher lows.

The 50-Day SMA (blue) is above the 150-Day SMA (green) and both are sloping up, confirming a long-term uptrend.

This indicates that stocks in the Consumer Staples sector are continuing a long-term uptrend due to the confirmation of the rate cut cycle beginning.

Technical Outlook: Bullish

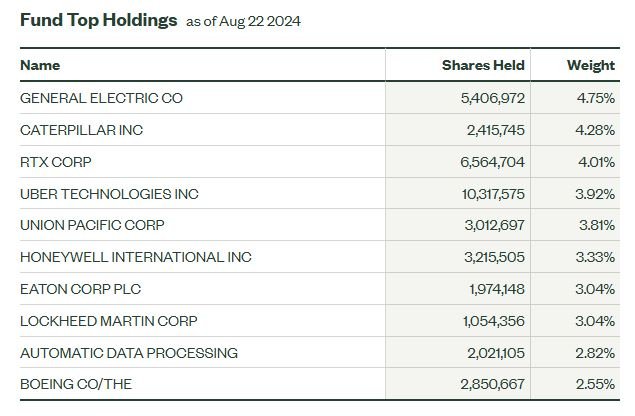

4. Industrial Stocks - XLI

Industrial companies often invest in large capital projects. Lower interest rates reduce the cost of financing these projects, potentially leading to increased investment and growth.

XLI Top 10 Holdings

XLI Technical Analysis

XLI has broken out to new all-time highs on August 23, 2024.

A clear uptrend has formed, as indicated with the arrows by price making higher highs and higher lows.

The 50-Day SMA (blue) is above the 150-Day SMA (green) and both are sloping up, confirming a long-term uptrend.

This indicates that stocks in the Industrial sector are continuing a long-term uptrend due to the confirmation of the rate cut cycle beginning.

Technical Outlook: Bullish

5. Utilities Stocks - XLU

Utilities are capital-intensive and typically carry significant debt. Lower interest rates decrease their interest expenses, enhancing profitability. Moreover, utilities are often seen as bond proxies due to their stable dividends, making them more attractive when interest rates fall.

XLU Top 10 Holdings

XLU Technical Analysis

XLU has broken out of its long-term downtrend line on March 28.

A clear uptrend has formed, as indicated with the arrows by price making higher highs and higher lows.

The 50-Day SMA (blue) is above the 150-Day SMA (green) and both are sloping up, confirming a long-term uptrend.

This indicates that stocks in the Utilities sector are continuing a long-term uptrend due to the confirmation of the rate cut cycle beginning.

Technical Outlook: Bullish

6. High Dividend Yield Stocks - SDY

In a low-interest-rate environment, investors often seek higher yields from dividend-paying stocks. Companies with strong, stable dividends can become more attractive as alternatives to fixed-income securities.

XLU Top 10 Holdings

XLU Technical Analysis

SDY has broken out to new all-time highs on August 15.

A clear uptrend has formed, as indicated with the arrows by price making higher highs and higher lows.

The 50-Day SMA (blue) is above the 150-Day SMA (green) and both are sloping up, confirming a long-term uptrend.

This indicates that High Dividend Yield stocks are continuing a long-term uptrend due to the confirmation of the rate cut cycle beginning.

Technical Outlook: Bullish

Why These Sectors Benefit from Interest Rate Cuts

Lower Borrowing Costs: Companies can finance operations, expansions, and acquisitions more cheaply, potentially increasing profitability.

Increased Consumer Spending: Consumers may have more disposable income due to lower loan and mortgage rates, boosting sales for companies in consumer-focused sectors.

Higher Valuations: Lower interest rates often lead to higher valuations for stocks, especially growth-oriented ones, as future earnings are discounted less.

Shift in Investment Preferences: Investors may move capital from fixed-income investments to equities in search of higher returns, benefiting the stock market.

Potential Risks and Considerations

While certain sectors tend to benefit from interest rate cuts, it's essential to consider the broader economic context:

Economic Health: Interest rate cuts are often implemented during economic downturns. While some sectors benefit, others may suffer due to reduced consumer confidence and spending.

Sector-Specific Risks: Not all companies within a benefiting sector will perform well. It's crucial to assess individual company fundamentals.

Inflation Concerns: Prolonged low-interest-rate environments can lead to inflationary pressures, which may erode purchasing power and affect corporate profits.

Market Sentiment: Investor sentiment can change rapidly, and market dynamics are influenced by numerous factors beyond interest rates.

Take the Next Step in Your Investing Journey – Join Us for Free

Be a part of our growing community of investors and traders. Gain access to the following resources, all for free:

Valuation Database - monthly stock valuation estimates and analysis

Trading Strategies - generate consistent monthly income

Stock Alerts - be alerted on a compelling investment or trading opportunity

Market Analysis - weekly market analysis to ensure you’re always one step ahead

The Vault - your comprehensive resource for stock market articles

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as financial advice. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.